Updates Digest for June! Improvements for Rithmic connection, DOM Trader and Option Analytics panels

Navigation

It's been a long time since we released news about our updates, but there were reasons for that. Now the updates will come out more frequently and will also include new connectors, improvements, and bug fixes. Well, let's move on to our news :)

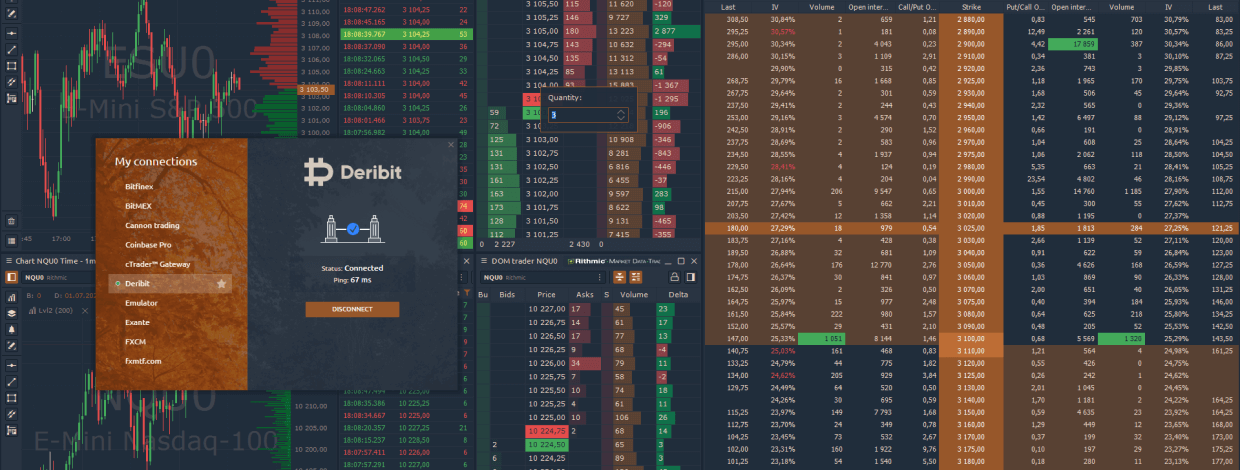

Aggregated trades in Time & Sales panel

This new mode in Time & Sales panel, also known as Reconstructed Tape, allows tracking large traders, by summing up trades that match in price, direction and time. For example, if at the price of 2998 single trades were executed at the same time (00:664) and direction (Sell), all trades are summed up.

By setting the additional Time Delay parameter, trades will continue to aggregate at different times, but with the same price and direction.

By adding various conditions for coloring or filtering rows via the Setup Actions menu, you will see only the desired values. Please watch our video guide about this amazing feature and if you have any questions or suggestions, feel free to contact us or leave your comments below.

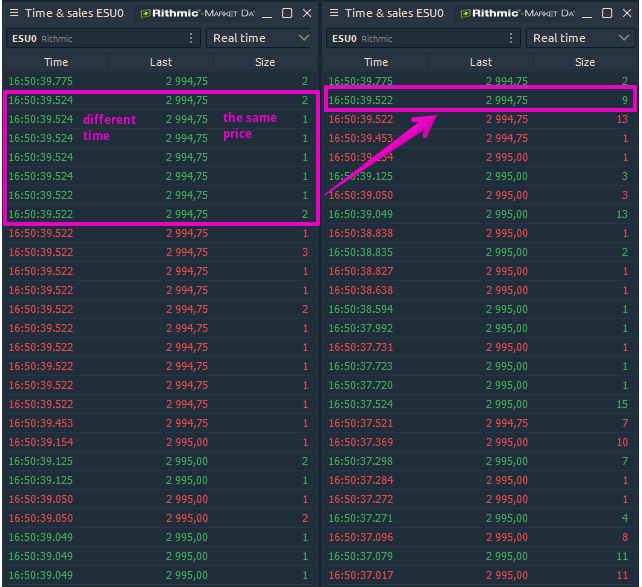

Trading & visual improvements in DOM Trader panel

We're always working hard to make Quantower better and especially its main trading panels like DOM Trader. For the last month, hotkeys, visual changes, and improved performance have been added to this panel!

- Added Total Rows for Bids, Asks, Buy and Sell columns. This row shows the total number of placed orders at different prices that are outside the visibility area. In addition, it shows the sum of limit orders at Bid and Ask side, allowing to estimate the imbalance between buyers and sellers.

- Added the ability to change Custom tick size "on the fly" by holding Ctrl key and scrolling the mouse wheel.

- Added the ability to set the number of levels for Bid/Ask columns.

- Added the Ctrl+Q hotkey that will call a small window where you can quickly change the Order Quantity.

- Ctrl+1, Ctrl+2, etc. hotkeys will apply predefined Order Quantity from the list. This list can be changed in the panel settings by specifying the necessary order sizes or adding more buttons.

- Added a new confirmation that will ask about closing the panel. This option will save from accidental panel closing.

- Visual marker of the size for a new order. In case of accidental changes in the order size, you will notice with what volume the new order will be set.

- Increased speed of placing, modifying, and canceling orders with Rithmic connection.

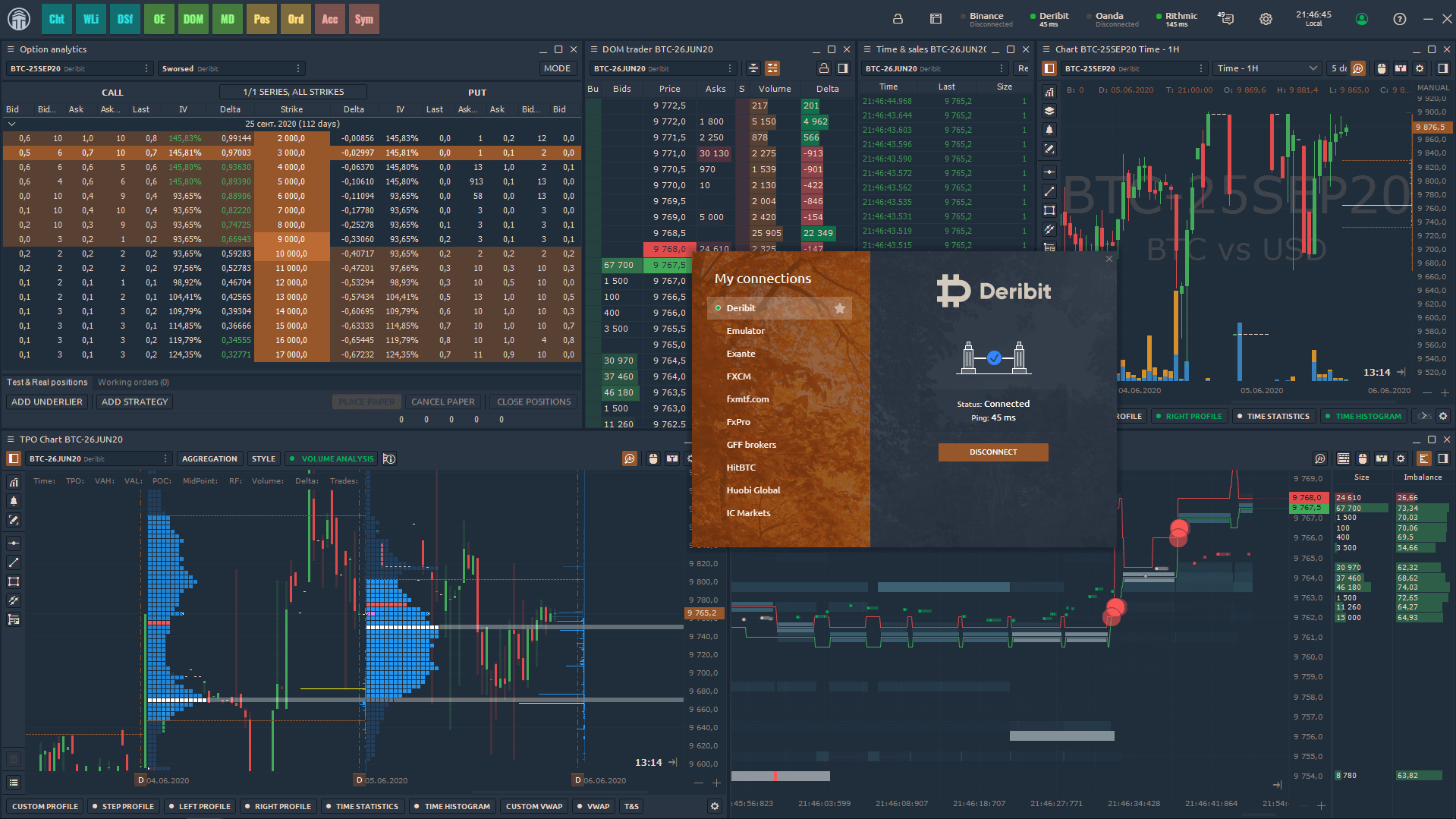

Trade connection to Deribit crypto exchange

Connection to the Deribit exchange opens new opportunities for traders. This crypto exchange allows you to trade futures and options on Bitcoin and the Ethereum, and is the largest exchange for trading Bitcoin options, taking up nearly 80% of the open interest market share. To start working through the Quantower platform, just paste your API Key and Secret Key.

Accelerated Volume analysis data loading and Tick charts for Rithmic

We have changed the mechanism of loading volume analysis and as a result, the loading time has been reduced by more than 10 times. We are sure that this is an excellent result that will allow futures traders to use volume analysis tools efficiently and quickly. Watch the video where you will see the difference in download speed between the previous version and the new one.

Another improvement for Rithmic is the faster loading of tick charts. For example, when opening the most popular charts of 2000 ticks or 1000 ticks for ES futures, traders had to wait for a long time until the chart was fully loaded. According to the new scheme, the chart is loaded as fast as a regular time-based chart. Don't believe us!? Open a new chart, select a tick chart type with any number of ticks and see for yourself!

New columns for Option Analytics panel

Several new columns and settings have been added to the panel, which will expand the analysis not only of options strategies but also of the underlying asset.

- Put/Call ratio based on Open Interest. It's a well-known ratio that shows the excess of put or call options. The higher the ratio, the more negative the directional bias is for the underlying asset. For Call/Put ration is opposite, the lower value, the more negative bias.

- Put/Call ratio based on Volume.

- OV ratio is an Open Interest/Volume of options.

- Added two new settings called Highlight Max OI and Highlight Max Volume. If the settings are enabled, the cells with the maximum Open Interest and Volume value are highlighted in the table.

- Added linking of Option Analytics panel. With this setting, a trader can combine the chart with the options desk, and see how the price of a particular strike has changed.

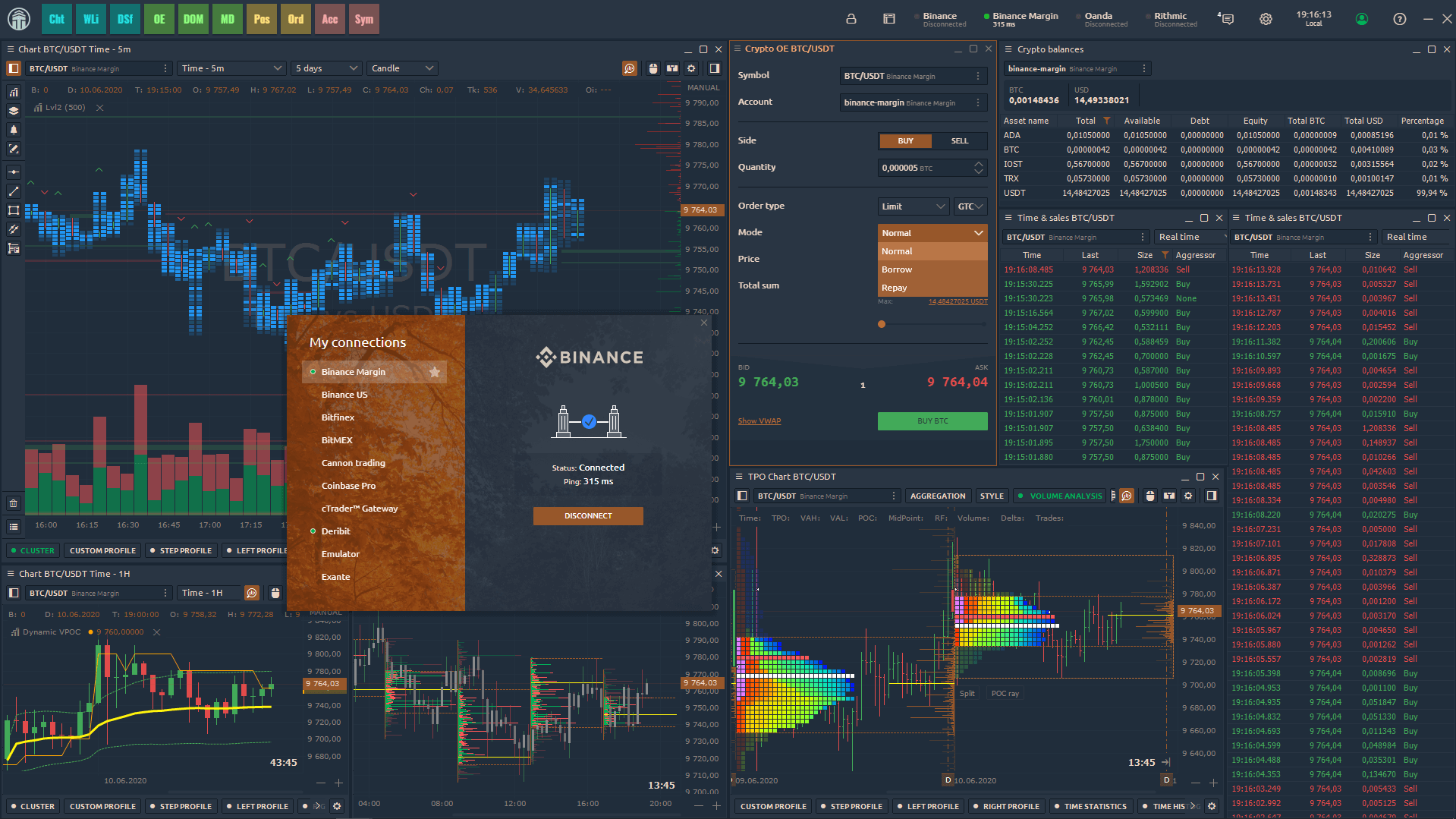

Connection to Binance Margin

The new connection extends the list of existing connections to Binance, most of which we have already implemented — Binance Spot, Binance Futures, Binance US. The main difference between Binance Margin and Binance Spot is that traders can borrow funds to increase their deposit before making a trade. This allows traders to expand their opportunities by trading with more instruments.

Account Operations panel

After we have connected Binance Margin, we received many requests to create a special panel, through which traders can transfer funds between their Binance accounts. We liked this idea and created the Account Operations panel.

This panel allows you to perform various operations with a trading account — Funds Transfer, Borrow, Repay. Currently, it works with Binance Margin, Binance Futures and Binance Spot.

Interactive Brokers fixes and changes

- Added a setting to specify the number of levels for the Market Depth. There is also an option to show the aggregated or Smart Market Depth with all available ECNs or only for a specific exchange.

- Resolved issue of displaying positions for the NASDAQ exchange. Due to the technical aspects of the broker's API, the platform has not seen any open positions for this exchange.

- Increased the speed of tick loading data.

- Fixed the problem of placing orders from the chart.

- Fixed issue with freezing quotes in the DOM Trader panel.

- Fixed issue with displaying orders in the DOM Trader panel.

Thanks to our users, we were able to find and fix these problems.

Comments