Option Analytics panel, IQFeed & Quandl data feeds, and multiple accounts

Navigation

It’s time for new release! This version makes a strong accent on the Option Analytics. It’s our new panel for creating and analyzing option trading strategies or profiles, as well as option Greeks. This doesn’t mean everything else was abandoned. As a first step towards the exchange market, we’ve added a connection to the DTN IQFeed market data provider. We also made the UI improvements and changed the logic of the login screen, that allows adding multiple trading accounts within one broker.

Ok, let’s dive into the details.

Trade options with the new panel, Option Analytics

At first glance, the panel looks familiar to option traders — Option Desk, Analyzer, Working Orders & Positions. But as soon as you start working in Options Analytics, you immediately notice the pleasant moments.

1. Joint mode of Option Desk & Analyzer

Add Paper positions in the options desk and the strategy analyzer will immediately show the option profile. This mode will allow you to see all changes in options desk — prices, volatility, options Greek values — and option profiles on one screen.

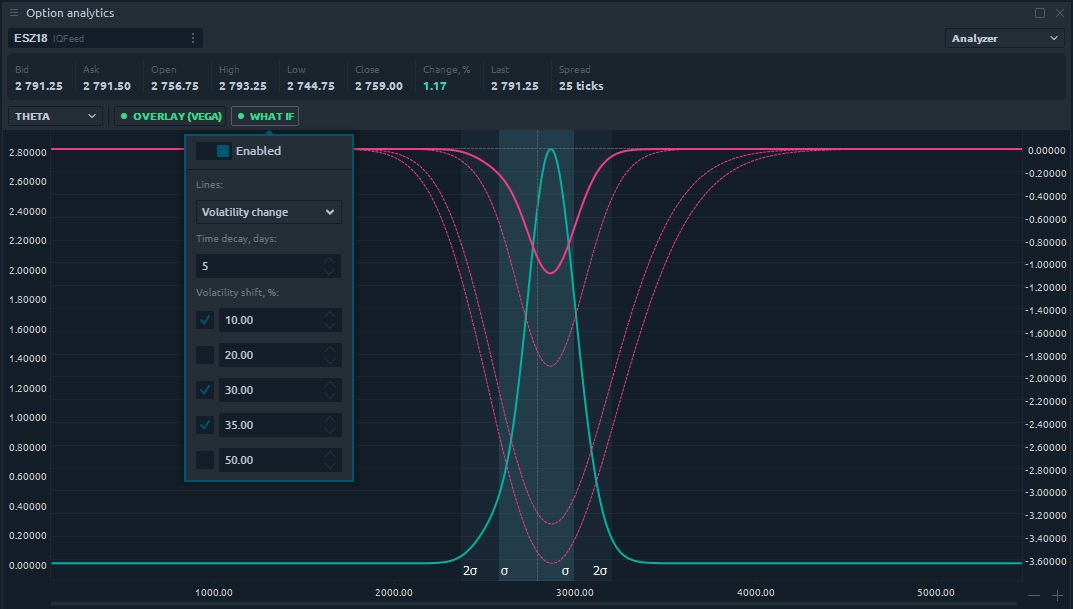

2. Overlays

Use the overlay functionality for a versatile analysis of the position, when creating option strategies. In addition to the P & L, you can add Delta, Theta, Gamma, Vega, Rho.

Thus, you simultaneously see changes not only for the option risk profile but also for other portfolio’s parameters.

3. Analysis of real & test options positions

Adding of test positions is performed with the options desk in a single click. To do this, select the strike you need, then in the Paper Positions column set the required number of orders. The selected strikes will immediately appear in the table of test positions, and the corresponding option profile will be displayed on the chart. By activating the checkbox in the Analyze column for the selected strike, you add it to the strategy builder.

4. What-if Scenario analysis

Assess the impact of volatility and time decay on the options trading strategy using What-if analysis.

Multiple trading accounts under one connection

We carefully analyze the feedback from our users and try to implement their requests as soon as possible. One of these requests, we have added to the current release — Multiple trading accounts under one connection. This option allows you to create and keep active multiple trading accounts for one broker. Due to this, the trader can trade and monitor his positions on different accounts, without the need to reconnect with them.

Note: Due to changes in the login screen, all previously saved passwords, logins and API keys will be deleted. Unfortunately, this is a necessary step for correct work with the new login screen.

Also, we changed the design of our login screen, which became a little more beautiful :)

Connection to IQFeed is ready to use

We’ve made an important step toward the exchange market by adding IQFeed market data provider. Recall that IQFeed is one of the best and most reliable suppliers of real-time exchange and OTC market data.

Using the IQFeed connection through Quantower, all traders will receive:

- Access to Futures, Equities, Forex and Indexes

- True tick by tick data – you see every trade and every quote as it happens to the microsecond timestamp

- Deep Historical Data – 180 days of tick data and years and years of minute data

- Over 500 market breadth indicators updating every 1 second – TICK, TRIN

Here are three simple steps to start using IQFeed connection:

- Download IQFeed client from the official website and install it

- Create a new account or use your existing one

- Select the IQFeed connection in Quantower and enter your login & password

Get more financial data with Quandl

We have made another connection in the current release. Quandl is international financial and alternative data provider that offers access to price data on stocks, futures, commodities, currencies, interest rates, options, indexes. Also, you will find a set of non-price data, such as fundamentals, forecasts, sentiment, traders commitment, economic data, and macro indicators.

To sum up

As always, we don't mention here less significant but numerous other fixes and micro-improvements. Be sure that they have been deployed, forming a solid foundation for best user experience and the future of the platform's development.

We’re eager to hear your thoughts and feedback. Leave them in our socials, Telegram channel, chat support on our website or in Skype.

Comments